In 2015, a Cubed3 article, The True Price of Games, went into depth on which countries had the cheapest games and consoles based on their income in nominated countries.

When the Switch was announced at the beginning of 2017, many started frantically typing prices into currency converters and crunching numbers to scour which country would be getting the best deal and where to import from, but more often than not, this method can incur high delivery costs and customs/import tax.

Then there were the 'keyboard warriors,' the unrelenting sass from a resentful fan base who complains that other territories get their hardware cheaper than others. This article will use the same economical methodology that was used in the aforementioned 2015 article to help analyse to see if these annoyances are substantiated.

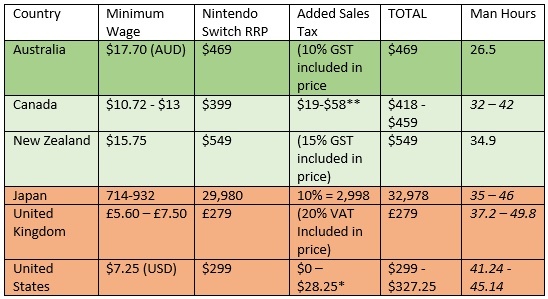

Using the base Recommended Retail Price (RRP) for the Switch and the minimum wage in each country, a calculation of 'man hours' (hours worked) is then made to see how long it takes to get a Nintendo Switch. Other factors will also be taken into account, such as any tax allowances and added sales tax in given countries.

The following countries will be used for the purposes of this article: the United States, Canada, Japan, Australia, New Zealand, and the United Kingdom.

* US sales tax varies by state. There are five states that don't pay any sales tax whatsoever, whereas the highest rate of tax is 9.45%.

** Canada's sales tax varies by province, from as low as 5% in some and as high as 15% in others.

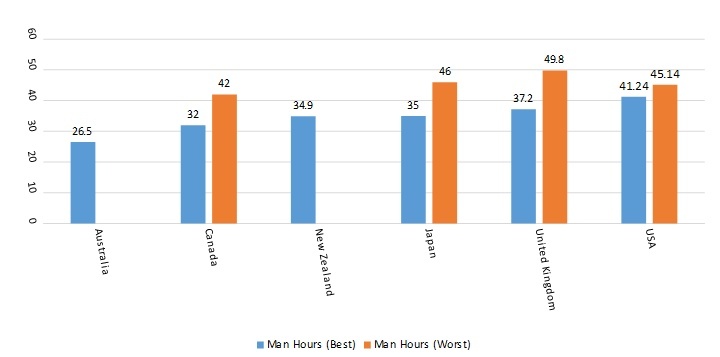

Calculating the man hours is not easy. Many countries have varying minimum wages for different ages, or varying sales taxes, which is why some countries have a large difference between the man hours worked, particularly in Canada and the UK. For example, a younger worker in the UK on £5.60 an hour will have to work almost 50 hours to get a Nintendo Switch, but an older worker on a higher minimum wage would essentially have to work a standard week of work before being able to splash the cash on a Switch.

It should also be noted that Australians not only just have high wages, but also get a tax free allowance of $18,200 on earnings, plus a further $445 allowance for low-income earners - although a similar, but not as generous, equivalent is also available in the UK.

Christmas is approaching fast and hardware bundles will perhaps skew the equations above. EB Games in Australia has not been suffering from stock shortages like in other territories, and even bundles two amiibo of choice with the console for no added cost.

Sign In

Sign In 02.08.2017

02.08.2017

Subscribe to this topic

Subscribe to this topic Features

Features

Top

Top